Get Turkish Citizenship by investment

In January 2017, the Government of Turkey published in the TC Resmi Gazzete (Official Gazzete of Turkey) an amendment of the Regulation on the Implementation of Turkish Citizenship Law.

The amendment established a citizenship scheme, under which foreign nationals, and their dependents, who contribute economically to the country, may become Turkish citizens. Economic contributions must be oriented to stimulate the real estate market, bring in foreign currencies and create jobs.

Investment in Bonds or Bank deposit

You may become a Turkish citizen if you make a deposit of US$500,000 in a bank operating in Turkey or you purchase Turkish treasury bonds or any type of government loan instruments with a value of US$500,000. You must commit to keep the investment for at least 3 years.

Requirements

– If you invest in a bank deposit, confirmation by the Banking Regulation and Supervision Agency that you have made a deposit of US$500,000 in a Turkish bank.

– If you invest in government loan instruments, confirmation by the Undersecretariat of the Treasury that you have invested US$500,000.

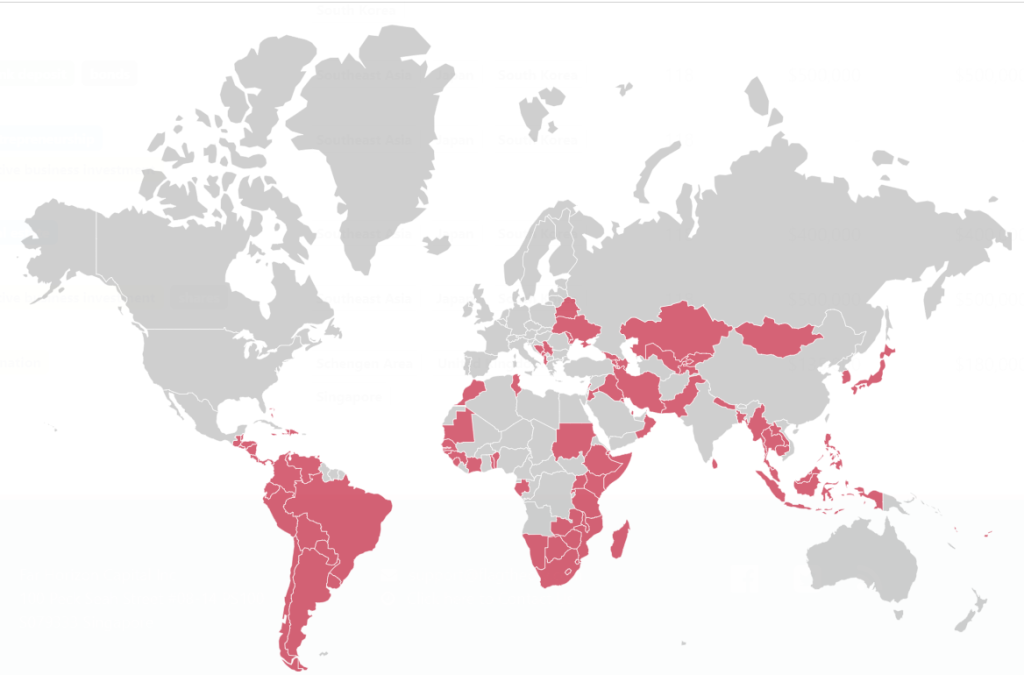

Visa Free Travel

Taxes

To be a tax resident in Turkey, an individual must have their legal residency in Turkey or stay at least 6 months per year in the country. Persons who stay more than 6 months due to a temporary assignment, may be considered as non-residents.

Residents are subject to tax on their worldwide income, while non-residents pay taxes on their Turkish-source income.

Personal income is taxed at progressive rates up to 35% on income exceeding TRY110,000.

Capital gains are subject to personal income tax. This excludes gains from the sale of real property held for more than 5 years. Certain gains derived from the sale of shares and capital market instruments may be tax exempt.

Dividends received from local entities are usually 50% tax-exempt; those from non-resident entities are fully taxable. A minimum tax-exempt threshold may apply.

Interest income is taxed between 0% and 18% depending on its nature. Rental income is considered taxable income, but an exemption may apply subject to certain conditions.

Turkey has enacted controlled foreign companies (CFC) rules. This means that profits retained in foreign entities owned and/or deemed to be controlled by tax residents, may be attributable if certain conditions are met.

Real property tax is levied at rates that range from 0.1% to 0.3%, depending on the type of property. Both buyers and sellers of real property are subject to a transfer tax of 4% (2% for each party).

Gifts are taxed at progressive rates from 10% to 30% and inheritances between 1% and 10%.

There is no wealth tax in Turkey.

V.A.T. is levied at a 18% rate. Reduced rates of 8% and 1% may apply for certain goods and services.

With regard to corporate taxation, resident entities are subject to a 20% income tax on their worldwide income. To learn more about the Turkish corporate legal framework, taxes and tax treaties, check out incorporations.io/turkey.