Get Dominican Citizenship by Investment Program

Get Dominican Citizenship by Investment Program, The Dominica Citizenship by Investment Programme is set out in the regulations published pursuant to Section 101 of the Constitution and Sections 8 and 20 (1) of the Citizenship Act.

The last amendment was made on 1 December 2016 in Legislation No. 38 of 2016. Through this program, a foreign-national that makes an economic contribution in the form of a donation to the Government Economic Diversification Fund, or a real estate investment, may become a citizen of Dominica.

The entity that manages applications and enforces regulations is the Dominica Citizenship by Investment Unit (CBIU), and citizenship granting is at the sole discretion of the CBIU director and senior examiners.

Non-refundable contribution to Dominica’s Economic Diversification Fund

– US$100,000 for the main applicant.

– US$175,000 for the main applicant and spouse.

– US$200,000 for the main applicant with up to three dependents (spouse and 2 children below 18 y.o.).

– US$ 25,000 for each additional dependent (children between 18-25 y.o. and parents/grandparents above 65 y.o.).

Funds are used for public and private projects such as: building schools, renovation of hospitals, building of a national sports stadium, promotion of the offshore, tourism, information technology and agricultural sector.

Requirements

– Main applicant must be 18 years old or older.

– Main applicant must prove that they have enough funds to make the required investment, and prove the legal source of these funds.

– Main applicant and dependents do not suffer contagious disease and/or serious health problems.

– Clean Criminal Record.

– Not to be subject of a criminal investigation.

– Not to be considered a potential national security risk.

– Not to be involved in any activity likely to cause disrepute to Dominica.

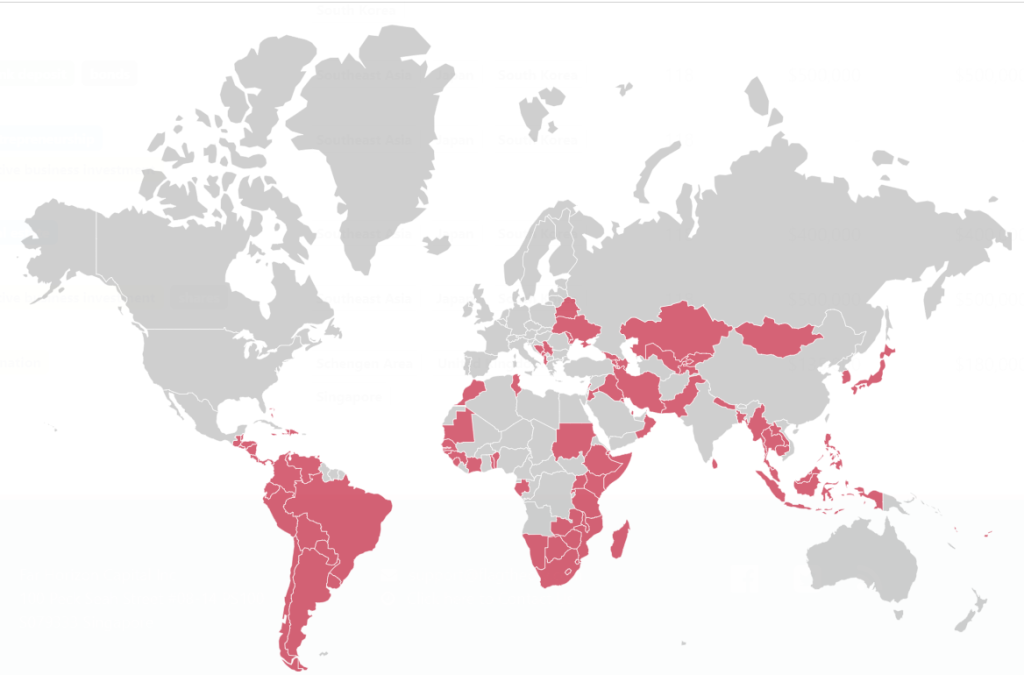

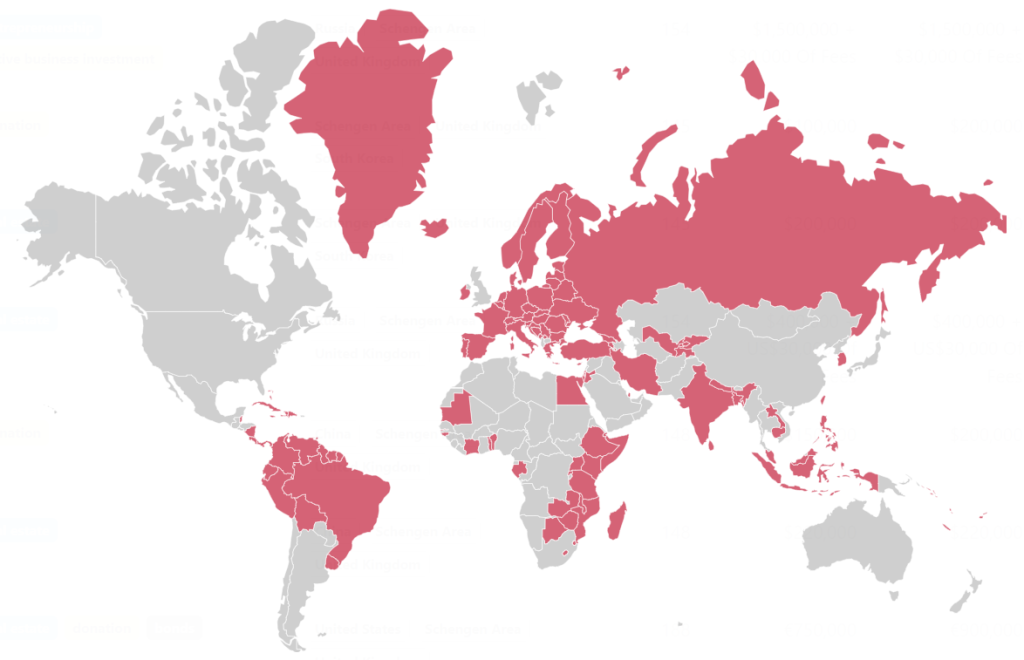

Visa Free Travel

Taxes

Becoming a Dominica citizen, does not automatically make you a tax resident. To be a tax resident an individual must:

- Have their permanent place of residence within the country and spend a period of time during the tax year in Dominica, unless purposes of absence are considered reasonable by the Comptroller of Inland Revenue, or

- Be in Dominica 183 days or more in the tax year, or

- Be in Dominica for a continuous period of less than 183 days, but resident the preceding or succeeding tax year.

Personal Income Tax is levied on a residence and remittance basis:

- Individuals resident or ordinarily resident in Dominica are subject to personal income tax on a worldwide basis.

- Individuals resident but not ordinarily resident are subject to personal income tax on their Dominica-sourced income and foreign-sourced income remitted to the country.

- Individuals non-resident are taxed on their income from Dominican sources and income from foreign sources remitted to the country.

- Personal Income tax rates are progressive up to a top marginal tax rate of 35% on annual income exceeding XCD50,000. Capital Gains are not taxable.

Dominica bank interests are tax-exempt. Dividends received are included in taxable income but a tax credit up to 25% of the net dividend received is usually available.

Dominica does not have Controlled Foreign Companies (CFC) Rules. This means that income retained in a foreign entity owned by a tax-resident may not be subject to taxation.

Municipalities levy a property tax of up to 1.25% of the property value, depending on type, location and use of the property. There is a 6.5% stamp tax on contracts for the transfer of assets. There are no net wealth and inheritance taxes in Dominica.

The Value-added tax (VAT) rate is 15%. Reduced rates and exemptions apply for certain goods and services.

Regarding corporate taxation, domestic companies in Dominica are subject to tax on their profits, whether accrued within or outside the country. Corporate Income tax rate is 25%. Dividends are subject to tax, but a tax credit is usually available. Capital gains are not subject to taxation. However, capital gains will be subject to taxation if they comprise a substantial portion of the income-earning activities of the business.

Contact us and for faster reply please click on the whatsapp button